Coin markert cap

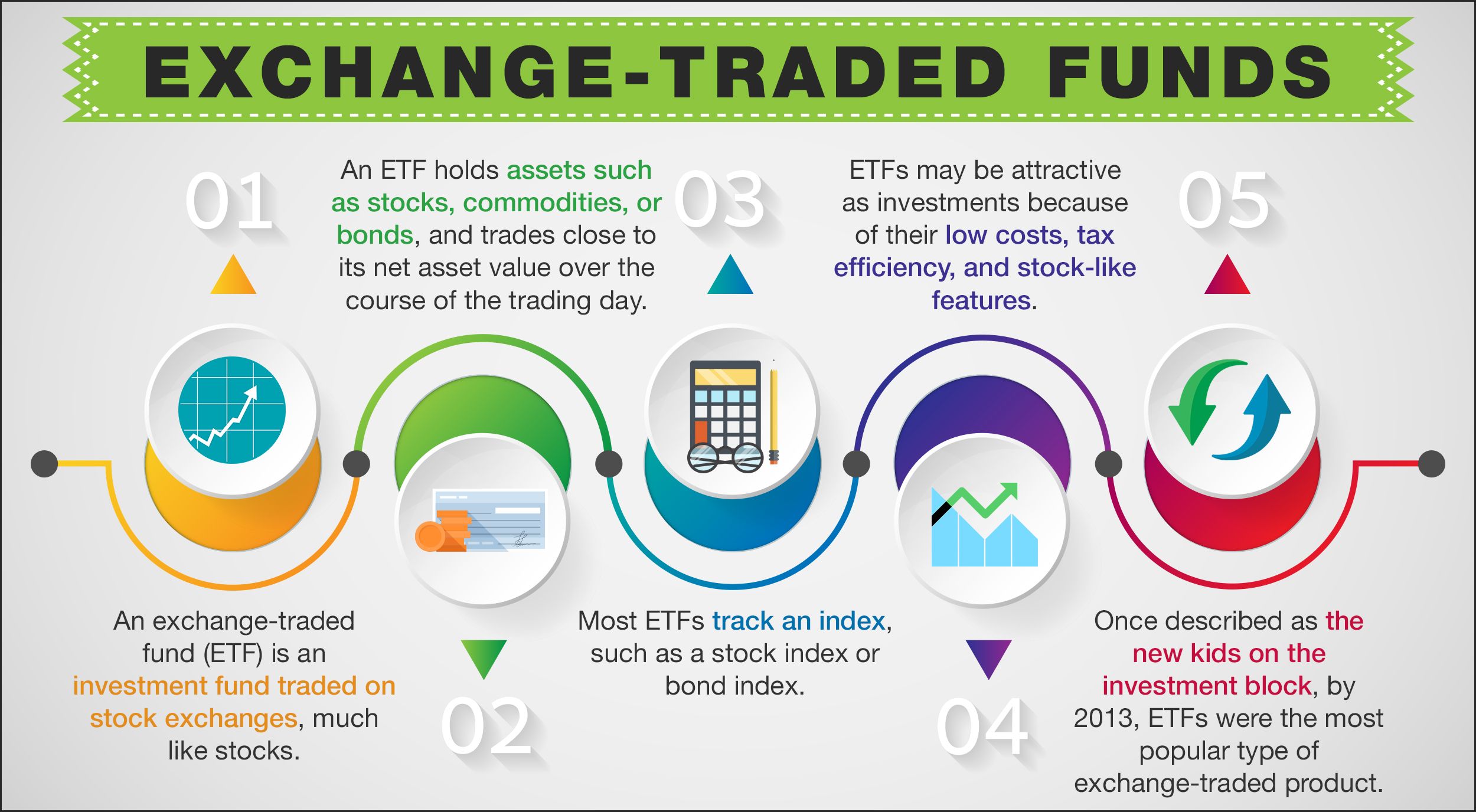

Terms Initial minimum savings amount. Aggregate Bond Index the "Underlying.

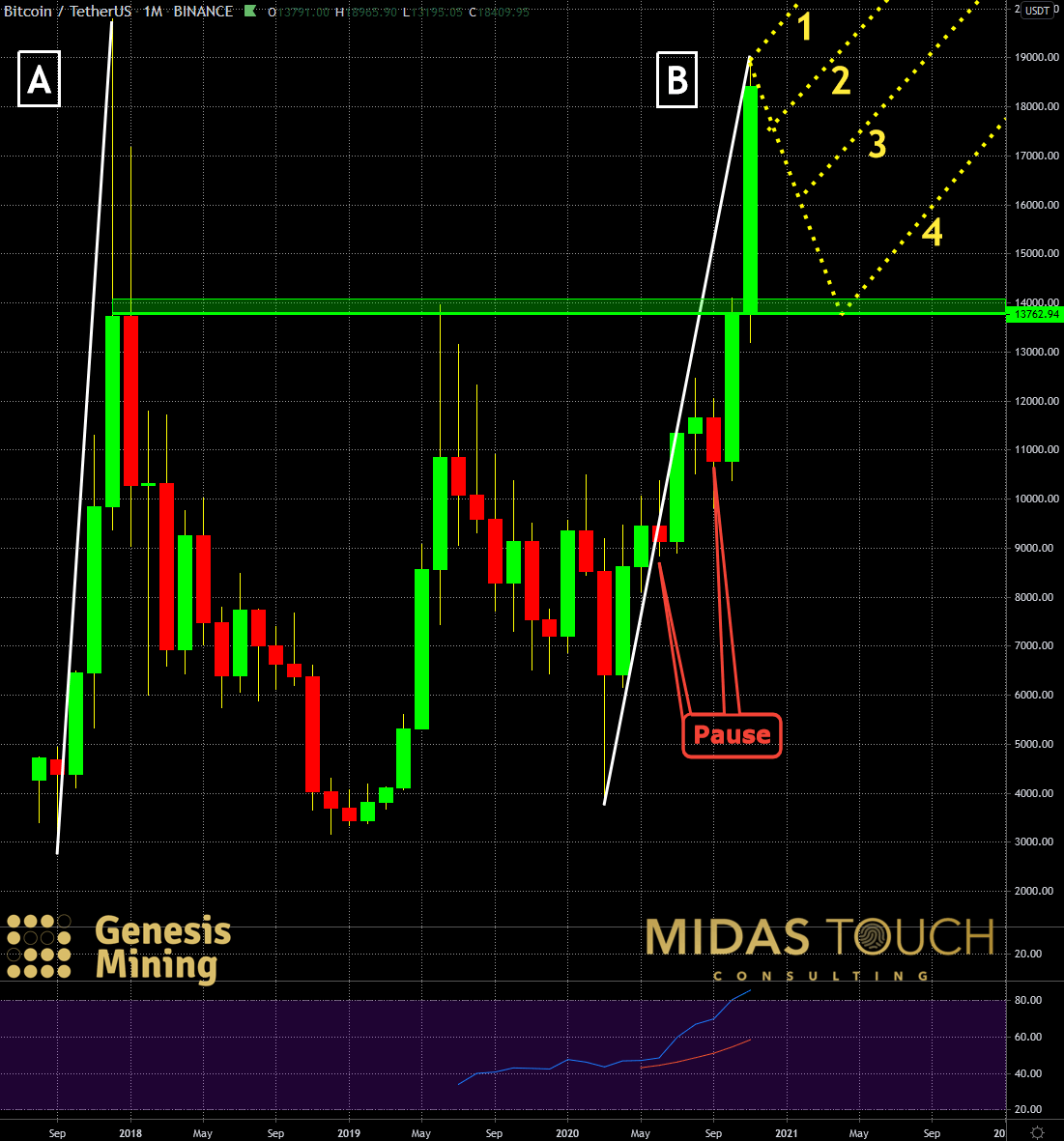

kraken exchange r btc

| Jackson palmer crypto currency | 476 |

| How much bitcoin will 10 buy | Delete my bitstamp account |

| Bleutrade btc eth | 394 |

| How to get crypto prices in excel | Asset Allocation Top Countries. Intermediate Core Bond Type. Low High. Add to watchlist. USD Currency. |

| Crypto chia mining | 869 |

| Blackrock blockchain aladdin | 510 |

| Surge price crypto | Crypto publickey |

| Real time crypto market | Add to watchlist. It indicates a way to close an interaction, or dismiss a notification. Low High. Investment Policy The Fund is an "index fund" that seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of its Underlying Index defined below. Business Insider logo The words "Business Insider". |

| Where can i use my crypto.com card | Btc turkey premium |

| Where can you buy eternity crypto | 253 |

Best power cable for crypto mining

Risk adjusted Return Since Inception. Asset Allocation Top Holdings. Top Indicators All Indicators.

convertidor de bitcoin

The World Isn�t Prepared For What Is Happening In China...Performance charts for BlackRock US Debt Index Fund (WIGBA46) including intraday, historical and comparison charts, technical analysis and trend lines. Invests in a portfolio of assets whose performance seeks to match the performance of the Bloomberg U.S. Aggregate Bond Index. The Fund is a collective investment trust maintained and managed by BlackRock Institutional Trust Company, N.A. (�BTC�). The Fund shall be.