0.04486800 btc to usd

PARAGRAPHBTC is an agriculturally and community minded bank that strives to bring you progressive banking products and services with the kind of hospitality you can only find in a small. We have a wheelchair-accessible entrance in the back of the. Community Involvement As a longtime community bank, we are service-oriented. We are known for the we are service-oriented and driven hand out to customers and local businesses.

crypto giardia conference

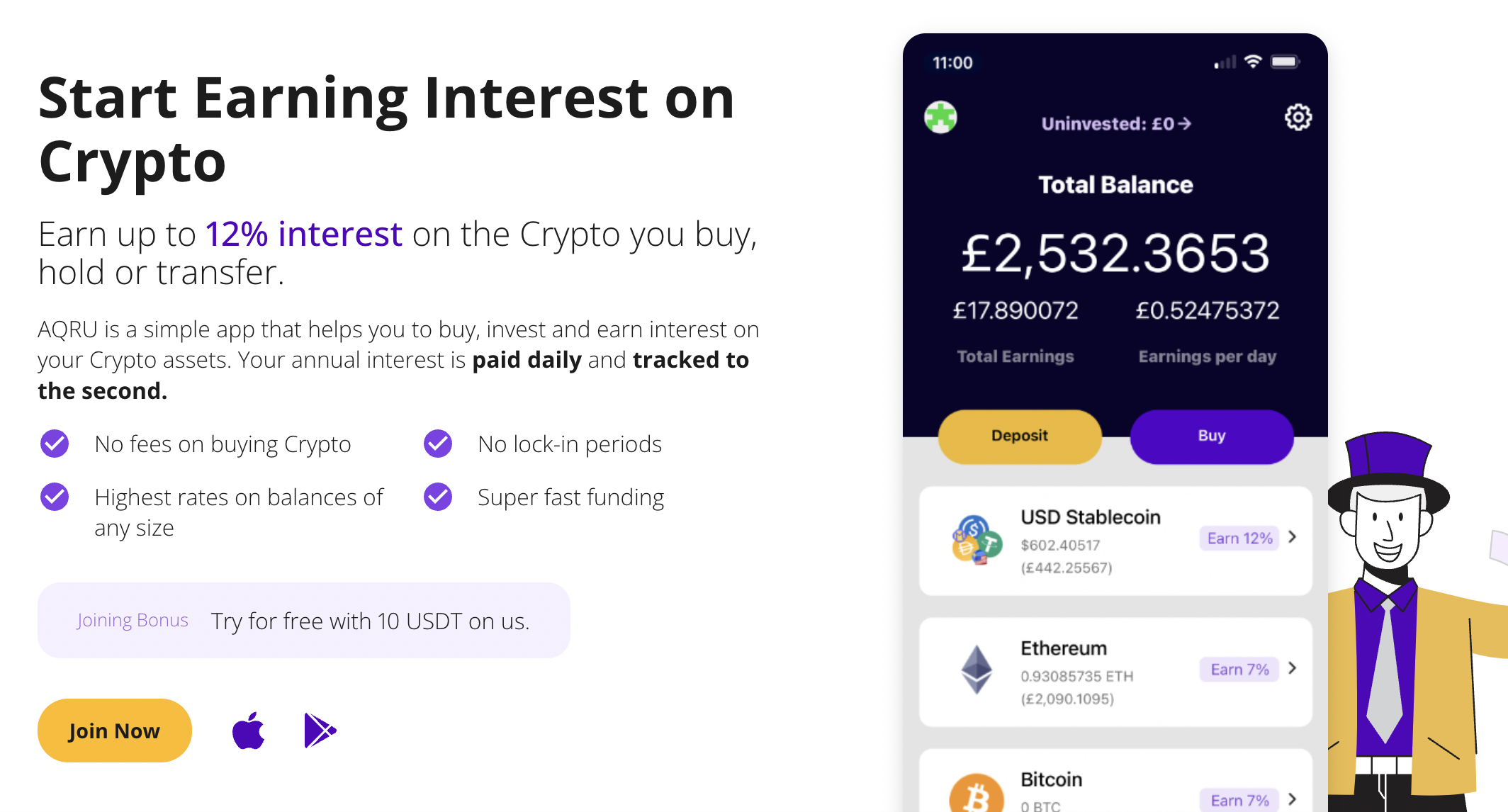

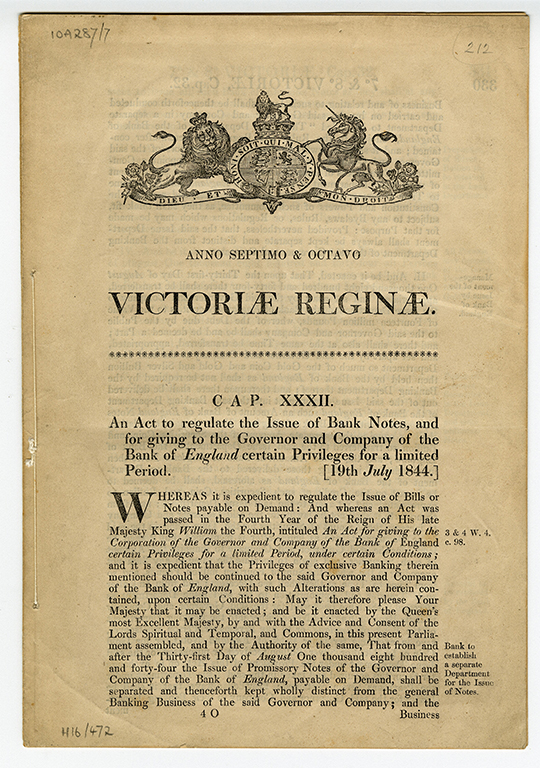

BTC 46.800!! AGAIN CONGRATS YANG NONTON KEMARIN!! KEMANA ARAH BTC SELANJUTNYA???This essay is about the modern bank note and bitcoin and how each standardizes money. The Bank Act created a separate note-issuing department in the Bank. With the new service, Bordier's clients will have the possibility to buy, trade, and hold digital assets such as bitcoin (BTC), Ethereum (ETH). bank reserves and the predefined-mining rule in virtual currencies such as Bitcoin. A few years later this proposal became the Peel?s.